Under the new tax package passed by the republicans at the end of 2017 known as the tax cuts and jobs act the medical expense deduction threshold has been reduced to 7 5 of agi but only for 2017 and 2018.

Agi floor for medical expenses 2014.

Let s say your agi in 2018 is 50 000 and you have 4 875 of qualified medical expenses.

Medical insurance premiums 3 700 doctor and dentist bills for bob and april emma s parents 6 800 doctor and dentist bills for emma 5 200 prescription medicines for emma 400 nonprescription insulin for emma 350 bob and april would qualify as emma s.

What remains is the amount of your deduction.

To calculate the medical expense deduction floor on your income you need to multiply 50 000 by 0 075 7 5 percent.

Here s how that breaks down on your tax return.

Generally the threshold to claim medical expenses as an itemized deduction was 10 of agi.

This publication covers the following topics.

Miscellaneous itemized deductions are those deductions that would have been subject to the 2 of adjusted gross income limitation.

Tax year ending december.

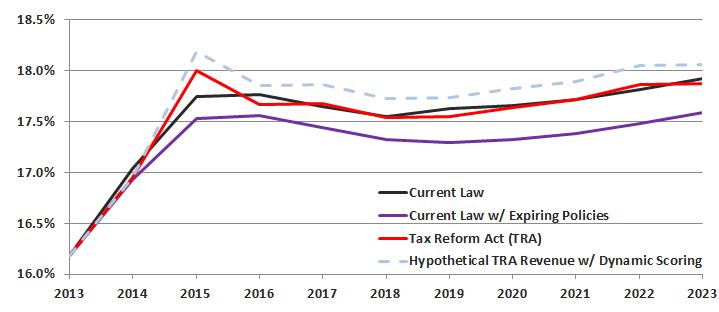

The following is the 10 year history.

If you itemize your deductions for a taxable year on schedule a form 1040 or 1040 sr itemized deductions pdf you may be able to deduct expenses you paid that year for medical and dental care for yourself your spouse and your dependents you may deduct only the amount of your total medical expenses that exceed 7 5 of your adjusted gross income.

So if john doe has an agi of 100 000 and a 10 agi floor then the first 10 000 of his medical.

For calendar year 2019 she had agi of 75 000 and paid the following medical expenses.

You can still claim certain expenses as itemized deductions on schedule a form 1040 1040 sr or 1040 nr or as an adjustment to income on form 1040 or 1040 sr.

For tax years 2013 2016 a 7 5 of agi floor for medical expenses was applied if a taxpayer or taxpayer s spouse had reached age 65 before the close of the tax year.

Enter the full amount for each expense and we will do the calculations for you.

On my federal taxes i have an itemized deduction of about 2 800 for medical expenses i exceed the 7 5 agi requirement.

It is increasing the amount taxed by 1100 on my virginia state return.

The deduction was scheduled to return to the 10 of agi threshold but the taxpayer certainty and disaster relief tax act of 2019 reverted the medical expense deduction from 10 to 7 5.

Basically these are expenses that are incurred to alleviate or prevent a medical or mental defect or illness including expenses related to dental and vision.

Before that change the floor was 10 percent for individuals under the age of 65.

When entering deductions in your account you do not have to do any of the following calculations.

Where was the medical expense deduction agi threshold historically.

Most itemized deductions are subject to a floor which is a percentage of the adjusted gross income agi that must be subtracted from the itemized amount to determine the deduction for instance most medical expenses can be itemized but they are subject to a 10 floor.